Income Tax Brackets for Estates and Trusts 2021 This is done to ensure long-lasting prosperity for the trust beneficiary. Trusts are often associated with estates, as they are often used to distribute the contents of sizable estates over time to their beneficiaries. Although times like this are incredibly sad, you will likely be on the hook for taxes if someone leaves you behind a sizable estate. An estate is essentially all of the assets that are left behind after a person passes on. Estates and Trusts Tax Brackets for 2021Įstates and trusts are a whole different ball game in the world of taxes. The income passes through to the individual shareholders’ tax returns and is taxed at the applicable tax rate. As a result, S-Corps don’t pay corporate taxes on their earnings. S-Corps are pass-through entities, so their profits flow through the entity and goes directly to shareholders.

S-Corps are a bit different than C-Corps in terms of how they function and how they are taxed. However, new legislation in the American Jobs Plan seeks to increase federal income taxes for corporations to 28% S-Corp Tax Rates 2021

2021 tax brackets filing single plus#

C-Corp Tax Rates 2021Ī C-Corp is taxed at a flat rate of 21% at the federal level, plus applicable state taxes. Since a corporation is treated as a completely different person from its owners, it’s taxed separately from the owners. Tax season becomes a bit more complicated for those who run a business structured as a corporation. You can find the tax brackets and their corresponding tax rates in the table below: Combined Income

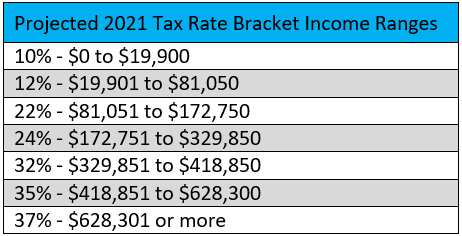

On the other hand, most people who are married file their taxes as married filing jointly. We’ve compiled the IRS 2021 tax brackets for married couples filing jointly. Below we’ve put together a table that shows the single filer IRS tax brackets for 2021, and their corresponding tax rates. If you aren’t married, then chances are you will be filing your taxes as a single individual. If you’re just learning about the tax code, it’s important to know that there are different tax brackets for people in different circumstances. When it comes to individual tax returns, you can file in a few different ways Two ways in which you can file your taxes are as a single filer, or as married filing jointly Single Filer Tax Brackets Most countries either have a flat tax rate (one rate that everyone pays), or a progressive tax rate (one that changes depending on the amount of income you earn in a given year). Income taxes in the United States are progressive, so the IRS has developed different tax brackets for various income levels.Īs your income grows, your applicable tax rate also increases. The government taxes higher earners more because they’re considered to have more disposable income. Stay tuned and dig into the IRS tax brackets for 2021 to learn more about how the government determines your tax rate. We’re going to cover everything you need to know about 2021 tax brackets and explain how new legislation could change the game. Your tax bracket depends on how much you earn, whether you’re filing jointly, and a few other factors. The government taxes everyone, but Uncle Sam taxes wealthier taxpayers at a higher rate. The taxable yield is 5.13%.If you have an income, you’re responsible for taxes. To get the equivalent taxable yield, divide 4.0% by 78% (100% - 22%). Taxable equivalent yield = tax-free yield ÷ (100% - marginal tax bracket %) or see which includes both federal and state income tax rates.Įxample: Assume you are in the 22% tax bracket, and have an account with a 4.0% tax-free yield.

You can compare yields by using the following formula: Below are the four individual tax rate schedules for 2021: Individual Tax Rate Schedules for 2021 Filing Status Your marginal tax bracket determines how much of the earnings from savings and investments you get to keep after taxes.

0 kommentar(er)

0 kommentar(er)